Imagine life as a puzzle, and personal finance as the glue that holds the pieces together. It’s the art of handling your money wisely – from the small daily choices to the big dreams you’re chasing.

Let’s explore the world of personal finance and get the answer to the most asked question in the finance community, “What is personal finance?”

Table of Contents

What is Personal Finance?

Personal finance refers to the comprehensive set of actions and decisions that an individual or a household takes to effectively manage their financial resources. It involves a wide range of activities that collectively contribute to achieving financial well-being and stability.

The key components of personal finance include budgeting, saving, investing, managing debt, planning for retirement, and being smart when you’re making money moves.

5 Areas of Personal Finance

Experts can’t seem to agree on everything when it comes to personal finance basics, but here we’ll zoom in on the main areas that really matter. So, let’s embark on a journey through the 5 key areas that constitute the heart of personal finance:

1. Income

Suppose your income is the bedrock upon which your financial stability is built. It’s the reward for your efforts, whether it’s the steady salary from your job, profits from investments, or other sources of monetary inflow.

It’s not just about the numbers on your paycheck; it’s about the opportunities they provide. A robust income not only funds your daily life but also lays the groundwork for your future aspirations.

According to the U.S. Bureau Of Labor Statistics 2023, the average yearly income in America is $56,940, which increased by $572 more than the statistics of 2022. As your income is increasing, take a calculative risk and focus on investing.

2. Spending

Think of your spending habits as a compass that guides you through the sea of everyday costs. From the roof over your head to the meals on your table and the experiences that color your life, spending encapsulates the essence of your financial choices.

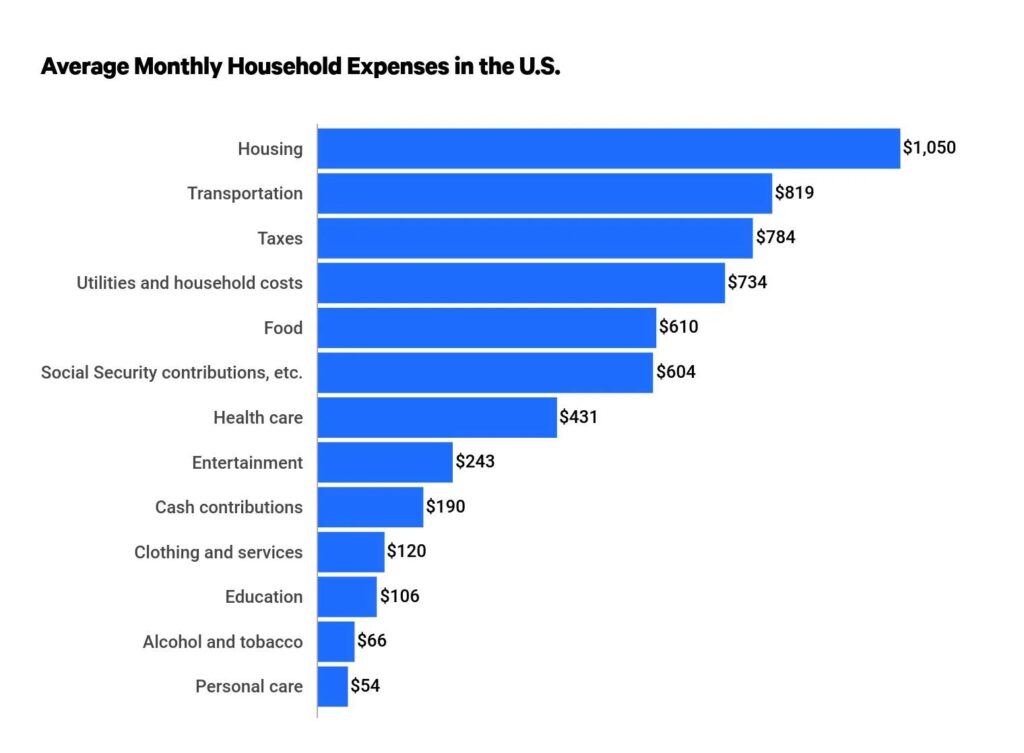

Tracking your spending helps reveal where your money is flowing, empowering you to make informed decisions and channel funds toward your goals rather than into the abyss of impulse buying. Also, check this chart of average monthly household expenses in the U.S. and make sure you are spending less than the average.

3. Saving

Think of saving as the canvas upon which you paint your future. It’s the act of setting aside a portion of your income today to make tomorrow’s dreams a reality.

Whether it’s the umbrella of an emergency fund, the keys to your dream home, or the serenity of a comfortable retirement, saving forms the bridge between your aspirations and your present actions.

4. Investing

Imagine investing as the gardener cultivating the seeds of your financial future. Just as seeds transform into flourishing plants, your investments can grow over time, yielding financial rewards.

However, this garden requires careful tending. Researching investment avenues, understanding risks, and aligning your investments with your goals ensures that your financial garden blossoms with the hues of prosperity.

5. Protection

Visualize protection as the guardian of your financial castle, shielding it from the storms of uncertainty. Life is full of surprises, both pleasant and challenging.

Adequate insurance coverage acts as a shield against unexpected job loss, health issues, or accidents. Additionally, crafting a financial contingency plan ensures you’re prepared to weather any tempest, reinforcing your financial fortress. Read Personal finance blogs and books, listen to popular finance podcasts, and attend personal finance workshops to improve your knowledge or hire a financial advisor.

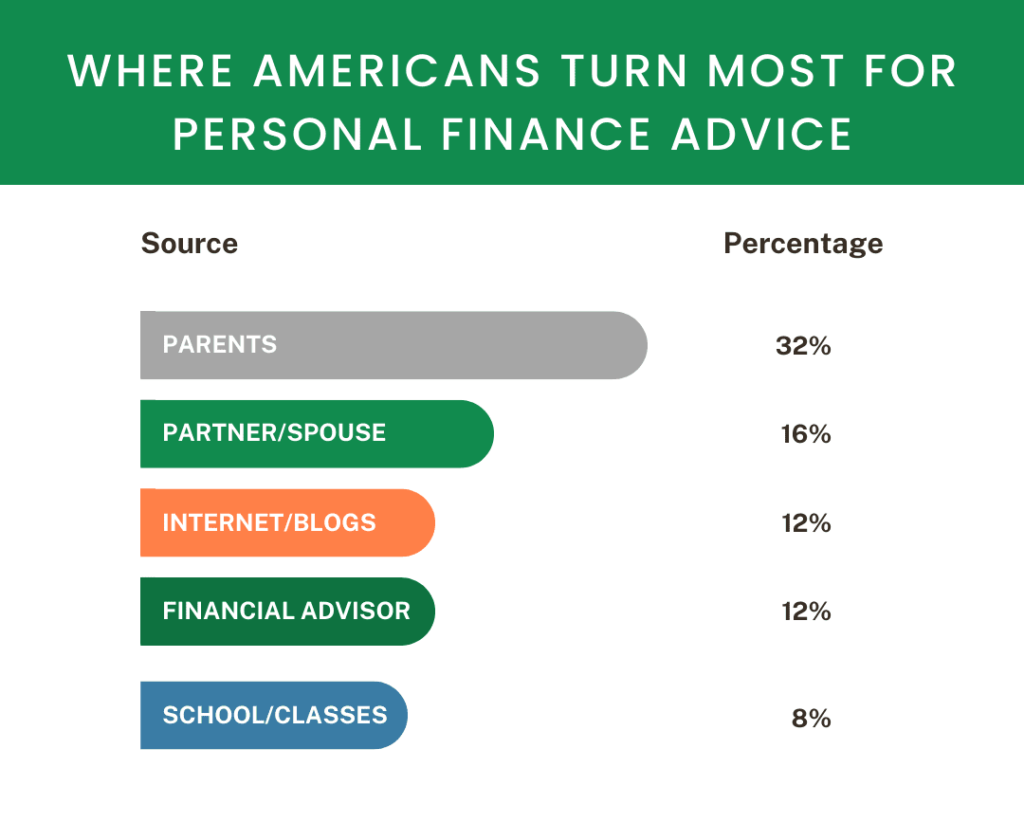

However, according to a survey of COUNTRY Financials, When it comes to learning about personal finance, most Americans actually go to their parents before checking out other sources.

Why is Personal Finance important?

Personal finance isn’t just a matter of balancing your checkbook; it’s a powerful tool that can reshape your financial journey and enrich your life in numerous ways.

Let’s delve deeper into why personal finance holds such paramount importance:

Achievement of Financial Goals:

Imagine your dreams as distant islands and personal finance as the map guiding you to reach them. Whether you yearn for a cozy home, dream of retiring comfortably, or aspire to explore new horizons, personal finance lays the groundwork for achieving these goals.

By setting realistic plans, managing your resources wisely, and making prudent financial decisions, you turn aspirations into attainable realities.

Stress Reduction:

Financial uncertainty can cast a shadow of anxiety over even the sunniest days. However, personal finance acts as a beacon of light, illuminating the path ahead. When you meticulously track your income and expenditures and draft a financial blueprint for the future, you gain a sense of control.

This control translates into reduced stress and enhanced peace of mind as you confront the unpredictable with a well-prepared mindset.

Enhanced Decision-Making:

Think of personal finance as the compass guiding you through a labyrinth of financial choices. Understanding the principles of personal finance equips you with the knowledge to make informed decisions.

From choosing the right investment avenues to distinguishing between needs and wants, your grasp of personal finance empowers you to navigate through an ever-evolving financial landscape.

Asset Protection:

Life can be a journey of unforeseen twists and turns, some of which may pose financial risks. Here, personal finance acts as a guardian, protecting your hard-earned assets from the storms of uncertainty.

By having adequate insurance coverage and crafting contingency plans, you create a safety net that cushions you against the impact of unexpected events such as job loss, illness, or accidents.

Wealth Accumulation:

Just as a drop of water gradually shapes the landscape, every prudent financial choice contributes to your wealth accumulation.

By saving consistently, investing wisely, and avoiding unnecessary debt, personal finance allows you to build a nest egg over time. This accumulation not only secures your present but also paints a promising picture of your financial future.

Real-life Examples of Personal Finance

It’s a landscape where everyday decisions blend with financial acumen, forming the masterpiece of financial well-being. In the following examples, we’ll dive into situations where people have used their creativity to improve their financial lives:

Example 1: The Coffee Conundrum – A Lesson in Opportunity Cost

Imagine Sarah, a young professional who loves her daily cup of artisanal coffee. She decides to track her spending for a month and realizes she spends $5 on coffee every workday. Curious, she calculates that this amounts to $100 a month and $1,200 a year – a substantial sum.

Sarah decides to take a creative personal finance approach: she brews her own gourmet coffee at home, investing in high-quality beans and a state-of-the-art coffee machine. By the end of the year, she’s not only enjoyed delicious coffee every day but has also saved money for a dream vacation.

Example 2: The Sneaker Swap – Turning Passion into Profit

Meet Alex, an avid sneaker enthusiast. His closet is brimming with limited-edition kicks, but he realizes he rarely wears many of them. Taking a cue from personal finance wisdom, Alex decides to turn his passion into profit. He curates a selection of sneakers he’s willing to part with and sets up an online store.

As sneaker collectors flock to his unique offerings, he not only clears up space but also generates a steady stream of income. Alex reinvests the proceeds into stocks, watching his investment grow – a tangible reward for combining his interests with financial acumen.

Example 3: The Savings Snowball – A Family’s Financial Adventure

The Johnson family embarks on a creative personal finance journey: the Savings Snowball Challenge. Each family member starts with a jar and a small amount of money. Throughout the year, they make a conscious effort to save spare change and any extra dollars.

Every month, they combine their savings, and the total keeps growing – just like a snowball rolling downhill. As the challenge gains momentum, they involve friends and relatives, turning it into a friendly competition. By year-end, the Johnsons find themselves with a substantial amount saved, which they decide to donate to a local charity, teaching their kids valuable lessons about saving and giving back.

Example 4: The DIY Dream Wedding – Crafting Memories Within Budget

Emily and Daniel are in love and excited about their upcoming wedding. However, they’re also mindful of their finances. Instead of opting for an extravagant wedding that might strain their budget, they decide to get creative. They plan a do-it-yourself (DIY) wedding, enlisting the help of friends and family for everything from decorations to catering. Emily even designs her own wedding dress, and Daniel creates personalized playlists for the reception.

The result is a beautiful and memorable wedding that not only reflects their personalities but also allows them to start their married life without overwhelming debt, setting a strong foundation for their financial journey together.

These personal finance examples showcase how creative thinking and strategic decision-making can lead to financial benefits, from saving money and generating extra income to making meaningful investments in experiences and future goals.

Personal Finance Tips: Mastering Your Financial Destiny

Navigating the vast sea of personal finance requires more than just a compass – it demands a treasure trove of wisdom and strategies. Here are some invaluable tips that can steer you toward financial prosperity and security:

- Set Clear Financial Goals: Whether it’s owning a home, retiring comfortably, or conquering debt, having well-defined financial goals provides direction to your financial journey. These goals are the beacons that illuminate your path and motivate your every financial decision.

- Craft a Thoughtful Budget: Think of a budget as a blueprint for your financial life. It’s the compass that keeps you on track, helping you understand where your money comes from and where it goes. Creating a budget allows you to identify areas where you might be overspending and empowers you to make informed financial choices.

- Embrace the Power of Saving: Consider saving as the bridge that connects your present with your future aspirations. Even if you can only contribute a small sum each month, consistent saving accumulates over time. Allocate funds for immediate needs, such as an emergency cushion, as well as distant dreams, like retirement.

- Harness the Potential of Investments: Investing your money wisely allows it to grow over time. Research various investment options – from stocks and bonds to mutual funds – and tailor your investments to align with your financial objectives.

- Tackle Debt Strategically: If debt looms on your financial horizon, tackle it head-on with a strategic plan. Picture debt repayment strategies as tools that chip away at the burden. Choose a method that suits your circumstances – be it the avalanche method or the snowball approach – and watch your debt shrink with each payment.

- Safeguard with Adequate Insurance: Consider insurance as the armor that shields your financial castle from unforeseen attacks. From accidents to illnesses, life’s uncertainties can cause financial setbacks. Ensure you have the right insurance coverage to safeguard your assets and secure your financial well-being.

- Prepare for Retirement: Start planning early, setting aside funds to ensure your post-work years are comfortable. Retirement accounts like 401(k)s and IRAs can serve as the ships that carry you to a serene financial sunset.

The Bottom Line

Personal finance isn’t a destination; it’s a continuous journey that you’re now better prepared to navigate.

From setting your sights on goals to crafting budgets, from saving diligently to investing wisely, from conquering debt to safeguarding your assets, and from planning for retirement to making informed decisions – every choice you make shapes the contours of your financial future.

So, set your course with purpose, embrace the waves of opportunity, and navigate your financial odyssey with the confidence of a captain at the helm.