Let’s talk about something super important – personal finance. Don’t worry, we’re not diving into complicated stuff. We’ll cover the basics, like making budgets, saving, investing, and handling debt. Imagine this guide as your financial GPS, helping you navigate from your early years to retirement.

Get ready to level up your money game and make smart choices that’ll set you up for a comfy future!

Table of Contents

What is Personal Finance?

Alright, let’s break it down. Personal finance is like being the boss of your money. You decide where it goes – whether you’re earning, spending, saving, or investing.

That means personal finance is not just about making cash; it’s about using your earnings smartly to make your dreams happen and handle life’s surprises.

If you have financial literacy, it’ll help you to set up a solid money base for your goals and be ready for whatever comes your way.

Learn more about personal finance from our personal finance blog.

Financial Literacy: Why Learning Personal Finance Is the Real Deal?

Understanding personal finance isn’t just a good idea – it’s a game-changer. Whether you’re a recent graduate, a seasoned professional, or anyone in between, having a solid grasp of personal finance can set you up for success in both the short and long run.

But, what if you don’t implement the money management principles? let’s have an example:

Americans are drowning in debt because, well, many folks don’t quite get how to handle their money.

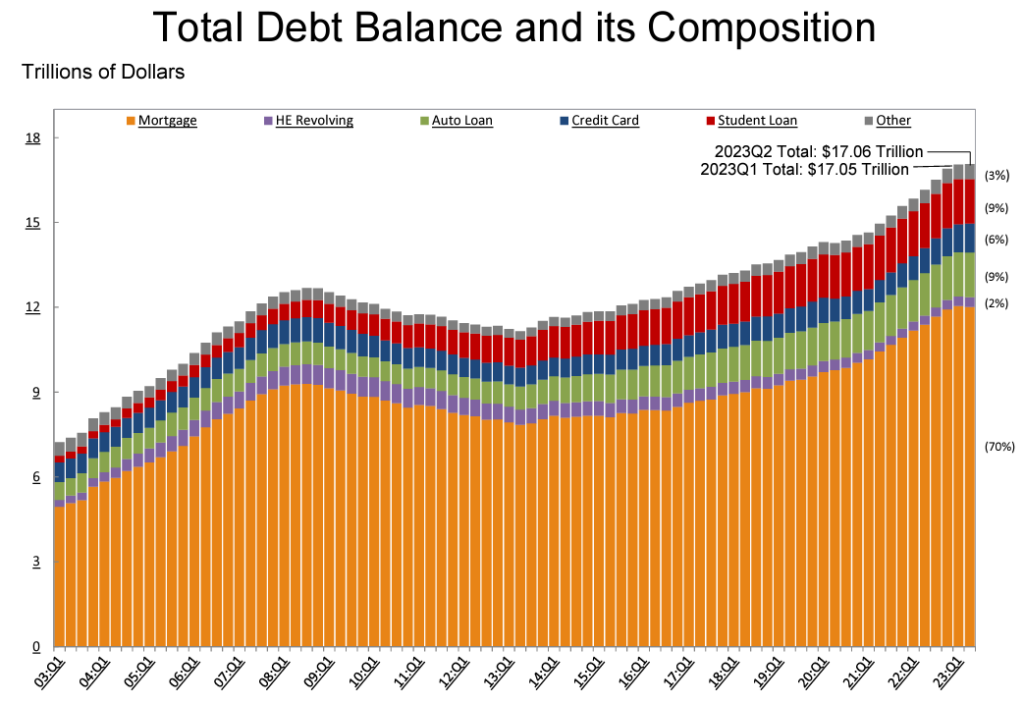

Guess what? According to the New York Fed Report Q2 2023, total household debt didn’t stay put – it actually jumped up by $16 billion, hitting a whopping $17.06 trillion in the second quarter of 2023.

Talk about big numbers! And get this, credit card debt sprinted ahead, shooting up by $45 billion to a crazy high of $1.03 trillion. Other balances, like those retail credit cards and other consumer loans, played catch-up too, adding $15 billion and $20 billion respectively.

But here’s a twist: student loan balances actually dropped by $35 billion to land at $1.57 trillion. Mortgages? Well, they pretty much hung out where they were at $12.01 trillion.

So, it’s important to have a perfect personal finance education.

Especially when things like inflation are chipping away at what your money can buy, and prices just keep going up.

Personal Finance 101: Navigating Your Money Journey

Money, it’s that thing that powers our lives, yet most of us never really learn how to handle it effectively. Whether you’re just starting out or looking to level up your money game, let’s dive into the essential pillars of personal finance that can set you on the path to financial success.

Budgeting: Where It All Begins

Let’s start with the big B – Budgeting. Budgeting is the cornerstone of personal finance. You list out what’s coming in (hello, paycheck!) and what’s going out (bills, groceries, and fun stuff).

Subtract the out from the in, and you’ll see what you’ve got left. This helps you avoid the dreaded “Where did all my money go?” question at the end of the month.

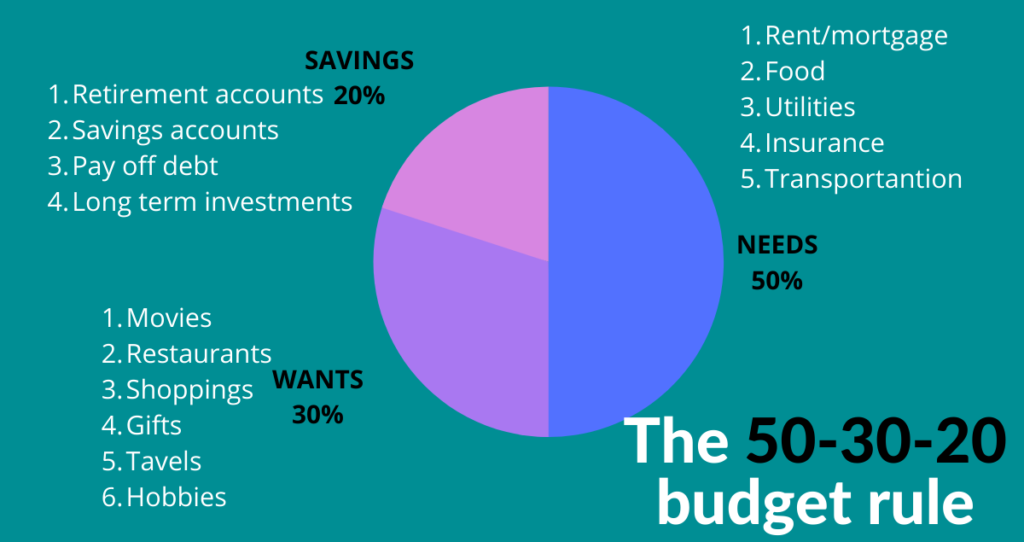

There’s this cool budgeting trick called the 50/30/20 rule in personal finance. Now, according to the 50-30-20 rule, divide your money like this: Put 50% into things you really need, 30% into stuff you want, and 20% into savings. That savings part also includes cash for things you’re dreaming about down the road.

Let’s break down these categories a bit more:

Needs: 50%

Around half of your money should cover things you can’t live without. Think of stuff like your bills for utilities. If you can’t imagine life without it, it’s a need. Even those basic payments on your credit card or loans go here.

Wants: 30%

This is the fun part. It’s for things you spend money on just because you enjoy them. Like getting a subscription to stream your favorite shows – you don’t need it to survive, but it’s nice to have.

Savings: 20%

The last chunk, 20%, is for the future. You could put it in an emergency fund or save up for a down payment on a house. Also, if you’re crushing it and want to pay off more debt than the minimum, this is where that goes.

Remember that the 50-30-20 rule isn’t the only way to budget. If you want something more personalized, it’s smart to chat with a money pro who knows their stuff.

Saving: Growing Your Money Tree

Savings are like the superhero of personal finance – they’re your safety net and your ticket to financial freedom. Think about it: By tucking away a slice of your earnings regularly, you’re giving yourself a cushion for those curveballs life throws your way – whether it’s surprising medical bills, sudden car troubles, or even a job hiccup.

But that’s not all – savings let you call the shots on life’s big decisions. Want to start a business, take a gap year, or go back to school? Having some cash in the bank gives you the power to say “yes” without worrying about your wallet.

So, Whether you’re still rockin’ your 20s and figuring out this whole money thing, or you’re cruising into your 30s and want to boss up your financial game, here’s the deal: you gotta start stashing some cash for down the road.

Seriously, it’s a must. So, no matter where you’re at, let’s get real about saving for what’s coming up ahead.

Investing: Make Your Money Work for You

Investing is like planting money seeds that grow into money trees. Basically, it’s like buying stuff – stocks, bonds, and all that – hoping to make more money than you put in.

The end game? Growing your piggy bank. But hold up, there’s a catch – not all things you invest in will make you rich. Sometimes you might even lose money. Bummer, right?

Now, here’s the deal: Investing can be a real head-scratcher if it’s all new to you. Best move? Dive into some reading and studying to wrap your head around it. If time’s not on your side, consider bringing in a money whiz to help you make the smart moves with your moolah.

Warning: If you’re throwing cash into Stocks, Bonds, or Crypto, you need to know how much risk you’re cool with and why you’re doing it.

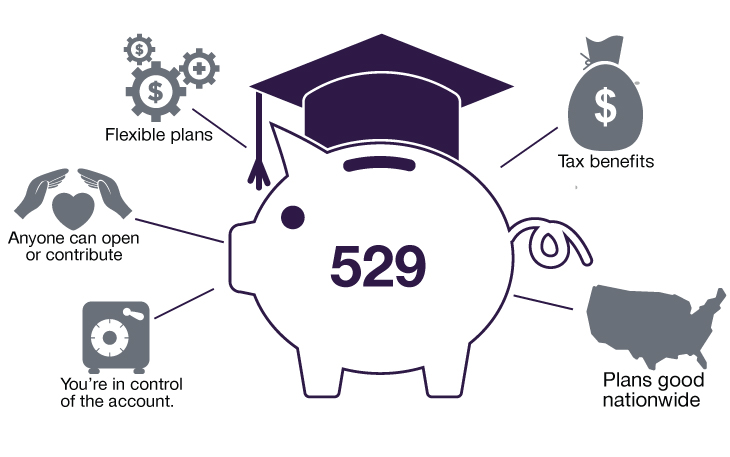

Ever thought about saving up for school? Check out this 529 plan thing. It’s like a super account where your money grows without getting hit by taxes, but there’s a catch – it’s gotta go towards school expenses. Oh, and it’s called a 529 plan ’cause of some fancy IRS rule. Check out 529 plan benefits below:

Debt Management: Breaking Free from the Shackles

Debt can be like a clingy ex – it just won’t leave you alone. High-interest debts, like credit card bills, are the real party poopers. Knock them out as soon as possible. But not all debts are evil; student loans or a mortgage can be your ticket to something great. Just keep them in check and don’t let them rule your life.

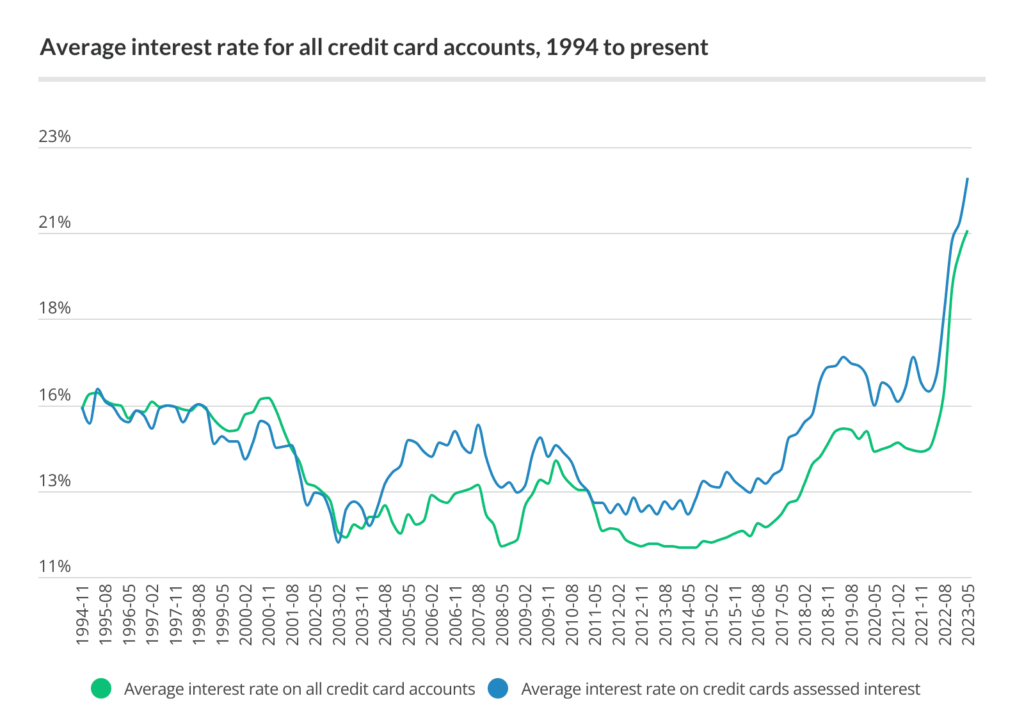

Also, do you know that interest slaps on your credit card bill if you’re late? The average interest rate on new credit card offers in America in June 2023 like crazy high, around 20.09%.

If you’ve got those pesky debts with sky-high interest, it’s a genius move to kick them to the curb. But that 20% credit card interest? Yeah, it’s a roadblock to your money goals.

If your credit score’s rocking, think about shifting your debt to a new card with zero interest for a bit. That means you’ve got, like, a year or more to tackle your debt without the interest monster growling at you.

So there you have it! These basic principles of personal finance are your roadmap to money awesomeness. Now, let’s explore why personal finance matters as you go through life’s different phases.

Your Lifelong Guide to Financial Success: From Start to Retirement

Managing your money wisely is a skill that pays off at every stage of life. Let’s explore why personal finance matters at different times and the important steps to take during each phase:

Early Adulthood (20s-30s): Setting the Groundwork

In your 20s and 30s, you’re building the foundation of your financial future:

- Setting Goals: Decide what you want to achieve financially, like buying a home or saving for a dream vacation. Start saving 10% – 15% of your gross salary. However, you have to save 20% or more of your salary to reach your retirement target.

- Creating an Emergency Fund: According to Bankrate’s 2023 annual emergency savings report, over half (57%) of adults in the U.S. can’t hustle up a measly $1,000 when the unexpected hits. And get this, 22% of American adults don’t have any savings for those curveballs. About 36% are rocking more credit card debt than emergency savings, which is the highest since 2011. On the flip side, 51% are sitting pretty with more emergency savings than credit card debt. So, Save money for unexpected expenses, like medical bills or car repairs.

- Saving for Retirement: Start putting money away for retirement in accounts designed for this purpose. if your job hooks you up with a 401(k) or 403(b) match, don’t snooze on it. Throw your bucks into that 401(k) up to the match limit and snag that sweet free cash! Now, if you’re already repping a regular 401(k) from work (the one where you stash money before taxes), it’s time for the next step: go for a Roth IRA.

- Learning to Invest: Begin exploring simple investments like Stocks, Mutual funds, Exchange-traded funds (ETFs), Bonds, and Certificates of deposit (CDs). Learning how to invest might seem overwhelming, but starting is key. Take baby steps and learn along the way to become a successful investor.

Mid-Life (40s-50s): Balancing Act and Planning Ahead

As you enter your 40s and 50s, you’re juggling multiple goals:

- Balancing Priorities: Save for retirement while also considering other needs like your kids’ education. In the USA, you can throw money into both your 401k for yourself and your kid’s 529 plan at the same time. Cool, right? Try to do so.

- Checking Insurance: Make sure your insurance coverage fits your current situation. When you’re figuring out if your insurance actually works for you, remember to think about a few things: how old you are and your health history, how much money you’re bringing in and what you can afford, how big your family is, your lifestyle, any health issue you had before, the kind of care you need, and which doctors and hospitals you prefer. And if you’re scratching your head about how to do this insurance thing right, no worries! Just have a chat with a health insurance agent or advisor. They’ll help you look at different plans and find the one that totally clicks with you.

- Reviewing Investments: Look at your investments and adjust them as needed. Also, it’s smart to check if they’re still doing what you want. You have to make sure your money plans match your goals and recheck the risk of investments. Look at your investments from time to time to fix any issues before they mess up your money game. Also, keep an eye out for new chances too!

- Preparing for Changes: Plan for significant life events, like paying for college or taking care of aging parents. If you need advice, discuss it with your financial advisor, a college financial aid counselor, or an aging care specialist. If you’ve got brothers or sisters, team up to look after your parents – it’s a group effort!

Pre-Retirement (The late 50s-60s): Getting Ready to Retire

As retirement approaches, focus on these steps:

- Boost Retirement Savings: Maximize your retirement contributions if possible. According to the IRS, The catch-up contribution limit for employees aged 50 and over is increased to $22,500 for 401(k) and the IRA limit goes up to $6,500 for 2023. Try to utilize the opportunity.

- Planning for Retirement: Work with experts such as a financial advisor, a fee-only retirement planner, a Registered Investment Advisor (RIA), or a certified financial planner (CFP) for the perfect retirement in America. You can ask people you trust if they have any recommendations for retirement planners. Once you have a few names, take some time to research each planner, and have a chat with them before you pick the one for you.

- Transitioning to Retirement: Think about how you’ll manage your money and daily life after retiring. Retirement is a great time to pursue hobbies and interests that you didn’t have time for when you were working. What do you want to achieve with your money in retirement? Do you want to travel, donate to charity, or simply relax?

- Estate and Legacy Planning: Prepare your assets for passing on to loved ones. If your children are young, you may want to consider creating a will or setting up a trust to protect their assets until they are older.

Finally, retirement might seem like a gazillion years away, but the sooner you start thinking about it, the better. Get cozy with retirement accounts such as 401(k)s and IRAs. The money you stash there now will turn into golden years of relaxation and fun later.

But, how can you improve your personal finance education process? Let’s have a look!

How to Enhance Your Financial Literacy in 2023?: A Path to Personal Finance Mastery

In a landscape where financial decisions wield a profound impact on our lives, enhancing your financial literacy is a journey that promises not only security but also the confidence to shape your own financial destiny. But, how can you learn Personal Finance in 2023? Let’s have a brief discussion regarding the common ways to enhance your financial literacy:

Self-Education: Equipping Yourself with Knowledge

Utilizing Online Resources: Blogs and Podcast

The internet is a treasure trove of financial wisdom. Countless websites, blogs, and videos are dedicated to simplifying complex financial concepts. Websites like Investopedia, Polapan, and The Balance offer comprehensive guides on everything from budgeting to investment strategies.

Personal finance blogs and YouTube channels deliver practical tips from experts and individuals who’ve walked the financial path.

Do you know what’s super chill and doesn’t eat up all your time? Podcasts! They’re like the low-key heroes of beefing up your personal finance smarts. No need to sit through boring lectures – just pop in your earbuds and you’re on your way to becoming a money guru.

Here are the 5 most popular podcasts on personal finance in 2023:

- How to Money – Hosted by Joel and Matt

- This Is Uncomfortable – Hosted by Reema Khrais

- Stacking Benjamins – Hosted by Joe Saul-Sehy and Josh Bannerman

- BiggerPockets Money – Hosted by Scott Trench and Mindy Jensen

- Side Hustle Pro – Hosted by Nicaila Matthews Okome

If you’re new to this whole money world and want to get your brain juiced up, these podcasts are where it’s at. Get ready to dive into personal finance like a boss by tuning into these popular shows.

Reading Personal Finance Books

Books are timeless companions on the road to financial literacy. Starting with beginner-friendly books, individuals can gradually delve into more advanced literature. Reading about personal finance not only imparts knowledge but also cultivates a deeper understanding of financial principles.

You should read these 5 most popular books on personal finance in 2023:

- Rich Dad Poor Dad – Overall best book on personal finance

- The Psychology of Money – Best for budgeting & money management

- The Ultimate Retirement Guide for 50+ – Best for retirement planning

- The Total Money Makeover – Best for credit ratings & repair

- Think and Grow Rich – Read about 500+ of America’s most successful individuals

You can take notes from these books and apply the learned concepts to real-life situations solidifying your personal finance learning process.

Attending Workshops and Seminars

Workshops and seminars on personal finance can provide opportunities for interactive learning. Many communities and organizations organize events on budgeting, debt management, retirement planning, and more. Attending these sessions allows participants to engage with experts, ask questions, and gain insights from real-world scenarios.

Seeking Professional Guidance: Navigating Complex Terrain

Benefits of Financial Advisors

Financial advisors bring specialized expertise to the table. They craft tailored financial plans for you based on your goals and circumstances, providing insights on investment strategies, tax optimization, estate planning, and risk management. Their ongoing support will ensure that your financial plans remain aligned with changing life circumstances.

How to Choose a Financial Advisor in 2023?

Selecting the right financial advisor is pivotal. Credentials like Certified Financial Planner (CFP) or Registered Investment Advisor (RIA) indicate their professional competence. You can take referrals from friends, family, or trusted professionals who can help you find an advisor with a proven track record as a personal finance advisor. Interviewing potential advisors helps gauge their approach, fees, and compatibility with your financial objectives.

Learning from Real-Life Experiences: A School of Practicality

Analyzing Personal Financial Mistakes and Successes

Reflection on past financial decisions fosters growth. Acknowledging missteps, such as overspending or inadequate savings can create an opportunity to make a perfect financial decision. Also, by identifying patterns in financial behavior, you can take proactive steps to improve your financial habits.

Learning from Case Studies and Success Stories

Real-life examples provide valuable insights. Financial case studies and success stories offer perspectives on how others navigated financial challenges and achieved their goals. Studying these Financial success stories allows you to extract applicable strategies, adapt them to your circumstances, and potentially replicate positive outcomes.

Whether you’re just starting to grasp the basics or seeking to refine your existing knowledge, this exploration of these steps to boost your financial literacy will serve as your guiding light.

But, what about the mistakes in your financial life that can cause a financial future at any stage of your life?

Navigating Financial Success: Avoiding Common Money Mistakes

If you are just starting your financial journey or seeking to rectify past mistakes, being aware of prevalent errors can significantly impact your financial health. Here are the top 5 most common financial mistakes that can cause financial failure:

- Neglecting an Emergency Fund: Not having an emergency fund is like walking a tightrope without a safety net. You never know when life will throw a curveball, whether it’s a crazy medical bill, your car giving up on you, or a surprise job hiccup. That’s why having a financial safety net is crucial – think of it as your cushion for rainy days. It’s recommended to have enough stashed away to cover your living expenses for 3-6 months, just to be on the safe side.

- Ignoring Debt Repayment: Overlooking high-interest debt, such as credit card debt, can impose significant financial strain. Prioritize paying off such debt promptly to alleviate this burden.

- Neglecting Retirement Savings: While retirement might seem distant, initiating retirement savings early is crucial. The sooner you commence, the more time your funds have to compound and grow.

- Overlooking Investment Opportunities: Investments offer the potential to increase your wealth over time. With various investment avenues available, you can opt for strategies aligned with your risk tolerance and financial aspirations.

- Lacking a Comprehensive Financial Strategy: Crafting a financial plan acts as a guide for your financial journey. This plan aids in establishing objectives, monitoring your progress, and making well-informed financial choices.

In the intricate landscape of personal finance, steering clear of these common financial blunders can pave the way for a brighter financial future.

Establishing an emergency fund, addressing debt, saving for retirement, exploring investment avenues, and creating a comprehensive financial plan are pivotal steps toward achieving your monetary aspirations.

The Bottom Line

Getting the hang of basic personal finance stuff is like getting the keys to being a smart money boss. It sets you up to actually know what you’re doing with your cash as you go through all sorts of life moments. The goal? Rock-solid financial backup and a life that feels awesome.

Remember, it’s all about diving into this learning adventure and using those money smarts for real. That’s how you get on the path to a future where dollar bills don’t stress you out.

Don’t sweat the blunders you might’ve made when you were starting out. We all make mistakes. As long as you build a game plan for your golden years, you’re setting yourself up to be a total money champ down the road.